Corporate Governance and Internal Control System

The establishment of an effective corporate governance and internal control system is essential for sustainable growth and long-term improvements in corporate value, and accordingly the Company works to strengthen such structures.

Corporate Governance and Internal Control Principles(265.9 KB)

Corporate Governance Report(682.4 KB)

Necessary Systems to Ensure Appropriate Operations and Status of Operation of the Systems(294.6 KB)

Corporate Governance

Basic Stance

A mechanism of corporate governance that enables management to make prompt and sound management decisions under appropriate and effective supervision is indispensable to the BIPROGY Group’s continuous growth and increase in medium- to-long-term corporate value. The Company shall create, maintain, and ceaselessly improve this mechanism.

Furthermore, in order to contribute to society as an enterprise resolving social issues, the Company stipulates as part of its corporate philosophy “Listen sincerely to our stakeholders to improve our corporate value” in order to create relationships of trust with all stakeholders, and shall proceed with its business activities in accordance with this principle.

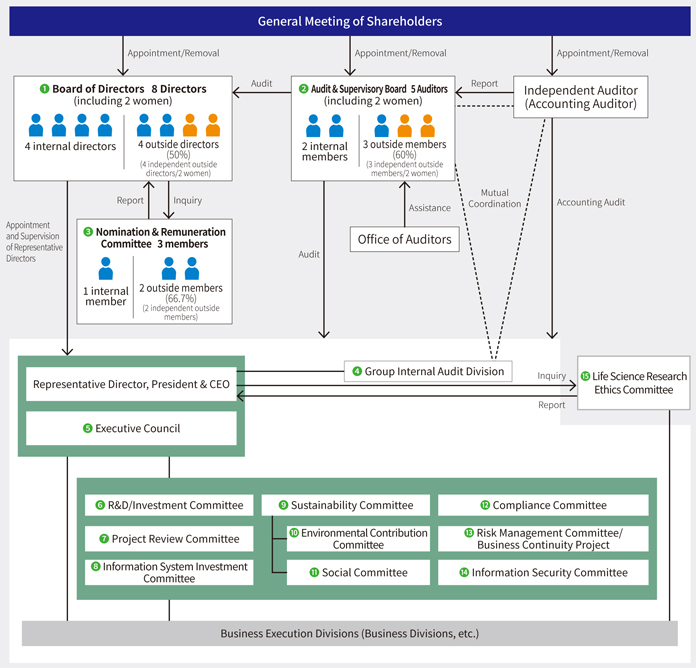

Corporate Governance Structure

BIPROGY has determined that an audit system involving supervision by a Board of Directors that includes outside directors and auditing by outside auditors is effective for monitoring management, and thus has adopted an Audit & Supervisory Board structure.

Corporate Governance Structure (As of June 29, 2023)

1. Board of Directors

The Board of Directors generally meets once a month. In addition to deliberation and deciding on the Company’s basic management policies, important matters, etc., it supervises overall management, including execution of duties by directors and corporate officers. The term of directors is one year so as to establish a flexible management system that can respond to changes in the business environment and to clarify the management responsibilities of directors. The Board of Directors met 12 times in FY2022.

Content of main deliberations in FY2022

- State of progress in implementing Management Policies (2021–2023)

- Matters related to personnel and evaluation of directors, etc.

- State of operation of the internal control system, including the Group’s risk management and compliance

- State of initiatives related to the Corporate Governance Code, including evaluation of Board of Directors effectiveness

- State of sustainability-related initiatives

- State of dialogue with investors

- State of handling of the loss of USB flash drives

2. Audit & Supervisory Board

Audit & Supervisory Board members audit the execution of duties by directors and the internal control system through their attendance of all important meetings including Board of Directors meetings, the examination of the operational and financial status, and the exercise of their rights regarding appointments and dismissal of accounting auditors and audit compensation. In order to increase the effectiveness of Audit & Supervisory Board member audits and facilitate the execution of audit functions, the Office of Auditors (1 full-time employee) aids the execution of Audit & Supervisory Board member duties. The Audit & Supervisory Board met 16 times in FY2022.

Content of main deliberations in FY2022

- State of initiatives to reinforce compliance framework

- State of initiatives to reinforce internal control system

- State of initiatives to reinforce risk management

- State of initiatives to prevent misconduct, etc., or their recurrence

3. Nomination & Remuneration Committee

This advisory committee to the Board of Directors deliberates and reports on matters pertaining to personnel and remuneration of our directors and corporate officers. The attendance of independent outside directors and the agreement of all members, including independent outside directors, are required when passing resolutions. The committee met 7 times in FY2022.

Content of main deliberations in FY2022

- Matters concerning composition of the Board of Directors and Audit & Supervisory Board and expertise and experience required of directors and Audit & Supervisory Board members (skill matrix)

- Personnel proposals regarding director candidates and corporate officer candidates (including representative director, order of acting directors and corporate officers, performance evaluation, appropriateness of reappointment, and successor training plan, etc.)

- Bonus payment amount

- Issue and allotment of restricted stock

*The results of deliberations by the Nomination & Remuneration Committee are reported and submitted to the Board of Directors.

4. Group Internal Audit Division

This independent in-house body directly under the President was established to audit the effectiveness and efficiency of internal controls through the Group. It confirms and audits the state of activities of Group committees, divisions, and Group companies. It also submits reports on internal audit plans and audit results to the Board of Directors.

5. Executive Council

The council, which is composed of corporate officers concurrently serving as directors and members appointed by the President, is a decision-making body for material matters concerning business execution and ensures efficient decision-making. Moreover, Audit & Supervisory Board members are able to attend Executive Council meetings, and full-time auditors normally attend.

Various Other Committees:

Deliberate on individual management issues related to directors’ execution of duties from a practical point of view

|

6. R&D/Investment

|

Deliberates on the advisability of plans for businesses, products and services based on the Group’s priority areas, and decides whether to invest in such plans. Also evaluates actual results versus forecasts for these plans and requests a review as necessary. |

|---|---|

|

7. Project Review

|

Determines the business risks, the validity of countermeasures, and the possibility of implementation for important development and service businesses. Also evaluates actual results versus forecasts for such projects and requests a review as necessary. |

|

8. Information System Investment

|

Deliberates on the advisability of cost, effectiveness, applied technologies and other matters for the Group’s own system development and operation and decides whether to invest in such systems. Also evaluates actual results versus forecasts for such plans and requests a review as necessary. |

|

9. Sustainability

|

Formulates measures and policies on achieving SDGs, determines the appropriateness of overall business activities from an ESG perspective, comprehensively determines action promotion and evaluations, and requests a review as necessary. |

|

10. Environmental Contribution

|

Analyzes environmental contribution-related policies, manages and monitors the design of mechanisms to promote environmental contributions and their implementation. |

|

11. Social

|

Consideration of policies on social fields, design of mechanisms to promote a social response and the management and supervision of the status of implementation, as well as other endeavors including corrective instructions on pending issues. |

|

12. Compliance

|

Oversees compliance programs such as Group compliance education and internal reporting. |

| 13. Risk Management/ Business Continuity Project |

Addresses various risks that exert a material impact on Group management and ensures business continuity. |

|

14. Information Security

|

Formulates strategies for overall Group security and personal information protection, and considers and promotes various measures based on those strategies. |

|

15. Life Science Research Ethics

|

Examines the validity of human-subjects research performed by the Company from an ethical and scientific perspective through an independent organization, and requests reviews if necessary. |

Initiatives to Enhance Corporate Governance

The BIPROGY Group ceaselessly improves on initiatives for enhancing corporate governance as a mechanism for implementing transparent, fair, prompt, and decisive decision making. To create business ecosystems, it is important to expand business opportunities through trust with a variety of stakeholders. Therefore, in addition to ensuring diversity of directors and Audit & Supervisory Board members, we also consider succession plans for rapid evolution a priority issue.

Changes in the corporate governance system

Diversity in Directors and Audit & Supervisory Board Members

The Board of Directors’ independent outside directors possess diverse backgrounds, including abundant experience and knowledge in management both in Japan and overseas, experience with venture investments and global business, advanced specialized knowledge in the fields of international taxation, gender, and ESG/sustainability. Four of the eight directors on the Board of Directors are independent outside directors, and two of them are women. The term of directors is one year to establish a flexible management system and to clarify the responsibility of directors. In addition, in the Audit & Supervisory Board, three of the five members are independent outside members, making up the majority, and includes one attorney, and two members who are women.

Composition of the Board of Directors and Audit & Supervisory Board

Board of Directors

Audit & Supervisory Board

Skill Matrix

* S of ESG (environmental, social, governance) includes human resource strategy, diversity and inclusion, etc.

* S of ESG (environmental, social, governance) includes human resource strategy, diversity and inclusion, etc.Reasons for selecting items in the skill matrix

| Business management experience at other companies |

Appropriate advice and supervision by outside directors who have management experience and achievements at other companies are effective in order to enable the management to transform the Company into a company that creates social value by making appropriate and prompt business judgements pursuant to the Management Policies (2021-2023) in the midst of the rapidly changing business environment. |

|---|---|

| Industry knowledge | A wealth of knowledge about the information service industry such as ICT and DX is essential for the Company in order to promote DX for its customers and society as stipulated in the Management Policies (2021-2023) and expand business ecosystems together with customers and partners. |

| Technology/ R&D | As technology evolves rapidly, a wealth of knowledge and expertise about technologies and research including advanced technology is essential for the Company in order to promote DX for its customers and society as stipulated in the Management Policies (2021-2023) and expand business ecosystems together with customers and partners. |

| Finance/ Accounting |

The Company needs directors well versed in finance and accounting in order to achieve transparent and correct financial reporting, strong financial foundation, strategic investments for sustained enhancement of corporate value and capital policy with consideration to appropriate shareholders returns. |

| Legal/ Risk management |

Risk management that enables appropriate and prompt responses to deal with diversified and complicated risks as well as strengthening corporate governance are indispensable in order to enable a medium- to longterm increase in corporate value. The Company needs a wealth of knowledge about these issues. |

| ESG/ Sustainability |

The Company needs a wealth of experience and expertise about efforts on climate change, workforce strategies, and promotions for ESG/sustainability issues such as diversity and inclusion in order to create a sustainable society as it aims under the Management Policies (2021- 2023). |

| Global business |

Borderless perspectives are indispensable in order to expand business ecosystems together with customers and partners. Thus, the Company needs a wealth of knowledge about global business. |

Appointment of directors

Candidates for directors who will concurrently serve as corporate officers (hereinafter, senior management) are selected from individuals who are highly motivated and have a strong sense of ethics as well as possess knowledge and experience to enable them to precisely and effectively manage the Company.

In addition, candidates for outside directors are selected while taking diversity into consideration and from individuals who possess abundant management experience and specialized knowledge, and are able to provide advice on and supervision of general management from an external, objective, and professional perspective. Senior management and outside director candidates are selected by the Nomination & Remuneration Committee, composed of a majority of independent outside directors, based on selection criteria and procedures formulated by this committee. The Board of Directors then makes its

decision based on that report.

Dismissal of directors

In the event that a member of senior management, including the CEO, violates laws and regulations or the articles of incorporation,commits an act of fraud, act of tort, or act of betrayal, or it is judged that they have not sufficiently served their office or fulfilled their function, the Company will remove such member from their position if it determines that the removal is justifiable based on deliberations by the Board of Directors.

Initiatives to Improve the Effectiveness of the Board of Directors

To continuously improve corporate value, BIPROGY considers it important for the Board of Directors to enhance governance by fully deploying its functions. Every year since FY2016, the Company has analyzed and evaluated the effectiveness of the Board of Directors in the previous fiscal year and worked to improve its functionality.

Board of Directors Effectiveness Evaluation Process

| Target | All FY2022 directors (8) and Audit & Supervisory Board members (5) |

|---|---|

| Board of Directors Effectiveness Evaluation Process |

Step 1 : Signed survey by all directors and Audit & Supervisory Board members Step 2 : Analysis and evaluation of content by outside consultants Step 3 : Deliberation and evaluation by the Board of Directors Step 4 : Formulation of action policies based on the evaluations Step 5 : Initiatives |

| Evaluation Items (56 questions in total) |

1. Role/functions of the Board of Directors 2. Progress of action policies for FY2022, which were determined after evaluating effectiveness in the previous fiscal year 3. Size and composition of the Board of Directors 4. Operation of the Board of Directors 5. Composition and role of the Nomination & Remuneration Committee 6. Operation of the Nomination & Remuneration Committee 7. Directors and Audit & Supervisory Board members training 8. Support system for outside directors 9. Role of and expectations for Audit & Supervisory Board members 10. Relationship with various stakeholders 11. Overall effectiveness of corporate governance system and the Board of Directors 12. Self-assessment 13. Response to the loss of USB flash drives |

Results of FY2022 Evaluation and Policies for FY2023

Issues Identified in FY2021

(1) Need to expand prior sharing of information in order to continue to deepen discussions on themes related to the essence of management and appropriately follow up with an eye toward enhancing the effectiveness of monitoring by the Board of Directors

(2) Need to conduct further discussions regarding the Group’s global strategies and human resource strategies

(3) Need to not only share information with outside director members more promptly and enhance the content of information in order to facilitate more active discussions at the Committee as the majority of Nomination & Remuneration Committee members are independent outside directors but also enhance the reporting of committee discussions to the Board of Directors to further enhance transparency of the Committee

Actions to Be Taken in FY2022

(1) Continue to enhance the effectiveness of monitoring by the Board of Directors by expanding the prior sharing of information to deepen discussions on themes related to the essence of management, such as human resource strategy and sustainability, and by following up appropriately.

(2) Discuss Group and global strategies and effectively monitor the progress of plans.

(3) With the majority of the members of the Nomination & Remuneration Committee being outside directors, in order to facilitate more active discussions at the Committee, work to further enhance the transparency of the Committee by sharing information with outside director members more promptly and enhancing the content of this information, as well as by enhancing the reporting of committee discussions to the Board of Directors.

FY2022 Evaluation

(1) Even though some progress was made, including expanding information sharing through training, holding meetings to exchange opinions, etc., it is necessary to further deepen substantive deliberations on themes related to the essence of management (management strategies, human resource strategies, global strategies, risk management, etc.)

(2) Although progress has been made on some fronts, such as deliberations and reporting on strategies by the Board of Directors, substantive deliberations regarding global strategies should be deepened after clarifying the goal and necessity of global expansion.

(3) Although many commented that progress has been made, and the Group’s response was highly rated, further enhancement of the reporting of the Nomination & Remuneration Committee’s deliberation to the Board of Directors is preferable.

Actions to Be Taken in FY2023

(1) In addition to further deepening substantive deliberations regarding not only management strategies but also human resource strategies, global strategies, risk management, and similar matters, taking into consideration management strategies, the Board of Directors will continue to expand the material necessary for that in order to generate further growth.

(2) In light of the incident involving the loss of USB flash drives in June 2022, the Board of Directors will promptly share information when a major incident occurs and monitor the state of initiatives to transform the organization’s culture and strengthen corporate officers and employees’ compliance and risk management awareness so that this type of incident never occurs again.

Succession Plan

In addition to integrity, a critical quality demanded of the CEO, the plan defines seven important competencies, including foresight and insight. We believe that the degree to which each requirement is demonstrated will vary depending on the business environment (whether the Company is in a period of transition/transformation, or one of extension and expansion).

Requirements (Qualifications/Competencies)

To facilitate the acquisition and strengthening of the above competencies, we plan and implement the Management Leader Program and visualize and monitor candidate talent to strengthen the pipeline of management leader candidates responsible for the future of the Group. This is achieved through assessments and tough assignments, in addition to sessions with internal and external management and experts.

Ability to Create New Value

Foresight refers to the ability to foresee the future of the BIPROGY Group, promote a vision with great aspirations and make a commitment to the future. Insight refers to the ability to understand global trends and changes, identify developments in the Japanese economy, in other words societal swings, and perceive essential value in everything. Determination refers to the ability to decide on a direction with unwavering conviction despite unpredictable conditions and with an awareness of the risks involved.

Ability to Improve

Innovation refers to the power to improve, leaving precedent and custom behind to ambitiously carve out a new path undeterred by difficulties. Passion refers to the ability to gain the cooperation, trust, and encouragement from those around you while passionately engaging in all endeavors and communicating extensively. This also refers to such attributes as a high sensitivity toward information and receiving capabilities, as well as the ability to convey objectives in the direction of realizing dreams, goals to be achieved, and solving problems.

Staying Power

Execution refers to the ability to steadfastly stay the course to achieve results by setting lofty goals companies should strive for and displaying leadership. Diversity and Inclusion refers to the ability to interact with a wide array of people whether inside or outside the Company, recognizing the values of people with various standpoints without stereotyping and pigeonholing them. This also refers to the ability to build proactive relationships based on an understanding of ideas from various corporate and cultural perspectives.

Management Leader Program

We have been carrying out the Management Leadership Program since 2018 with the goal of building a human resource pipeline for producing successors to senior management, seeking to generate management leaders committed to continuous transformation. As for the

Management Leader: Advanced program, one element of the leadership program, a total of 30 participants have participated in the program through FY2022 in order to acquire the necessary perspective, perception, and viewpoints for management leader candidates through dialogue sessions with directors and experts from inside and outside the Company.

Since FY2022, we have moved forward with centralizing data on human resource through the introduction of a talent management system, introducing new assessments, reforming both in-house and outside training programs, and redesigning our assignment mechanisms, and aim to link this to the Group’s sustainability management to strengthen the human resource pool and pipeline for candidates and build a system for more systematic and continuous generation of management personnel.

Nurturing future generations of management leaders

We hold CEO & Leaders Sessions as a place to nurture ambition to lead the Company and to share and discuss themes and issues that should be taken on from a management perspective and to connect those to action. In FY2022, 11 sessions were held, and more than 100 people participated each one.

Remuneration System

For remuneration for executive directors, the weight of performance-based bonus and stock remuneration was increased and, if performance targets are fully met, the fixed remuneration, performance-based bonus (linked to profit attributable to owners of parent), and stock remuneration are paid in a ratio of 4:4:2.

Non-executive directors are paid only a fixed monthly salary that is not linked to performance to guarantee effective advising and monitoring of management. Policies for determining director remuneration calculation methods are set through deliberations by the Nomination & Remuneration Committee, an advisory committee of the Board of Directors, and subsequently approved by the Board of Directors.

Restricted stock remuneration tied to medium- to long-term and long-term performance

In FY2021, we introduced a remuneration system that incorporates both performance targets linked to medium- to long-term performance and long-term performance conditions that include actual response to sustainability issues such as climate change. The goal is to enhance corporate value in the medium- to long-term and strengthen the linkage between compensation and medium- to long-term and long-term performance.

Total Remuneration in FY2022 for Directors and Audit & Supervisory Board Members with Subtotals for Each Type of Remuneration and Numbers of Recipients

| Classification | Total Remuneration Paid (Millions of yen) |

Remuneration Paid by Type (Millions of yen) | Recipients | ||

|---|---|---|---|---|---|

| a) Fixed Remuneration |

(b) Bonuses | (c) Stock Remuneration |

|||

| Directors (Excluding outside directors) |

297 | 147 | 109 | 40 | 5 |

| Audit & Supervisory Board members (Excluding outside auditors) |

34 | 34 | ー | ー | 2 |

| Outside directors and outside auditors |

73 | 73 | ー | ー | 8 |

(Notes)

1. One non-executive director is not eligible for bonus and stock remuneration.

2. Auditors and outside directors are not eligible for bonus and stock remuneration.

3. Amounts listed are rounded down to the nearest million yen.

4. The stock remuneration figures in the table above indicate the amounts recorded as costs for the fiscal year under review in the costs about restricted stock as remuneration granted to four executive directors.

5. The officer retirement benefit plan was cancelled as of June 30, 2006 as resolved at a meeting of Board of Directors convened on April 28, 2006.

6. The table above includes remunerations, etc. for two directors who retired at the conclusion of the 78th Ordinary General Meeting of Shareholders held on June 28, 2022.

7. In light of the loss of USB flash drives, Akiyoshi Hiraoka (Representative Director and President) voluntarily returned 20% of fixed remuneration (for three months), and the above amounts reflect the voluntary return.

Illustration of executive director remuneration

(a) Fixed remuneration (a monthly remuneration)

The monthly remuneration for directors shall be no more than ¥35 million, and for Audit & Supervisory Board members no more than ¥8 million.

(b) Bonus (linked to short-term performance)

The total annual amount of bonuses for executive directors shall be no more than ¥400 million, and is determined by the Board of Directors in accordance with a standard amount by position and a standard coefficient based on profit attributable to owners of parent as determined by the Nomination & Remuneration Committee (for now, up to 0.5%).

(c) Restricted stock remuneration

The Company has adopted a restricted stock remuneration plan for executive directors, which incorporates three requirements and indicators: (i) tenure condition, (ii) medium- to long-term performance target (total shareholder return (TSR) growth rate versus TOPIX), and (iii) ESG targets. These are paid at a ratio of 3:1:2, respectively.

The tenure conditions in (i) are designed to have executive directors share awareness and value with shareholders through share ownership. The performance indicator in (ii) is linked to medium- to long-term business performance, a comparative measure versus TOPIX of the degree to which we have independently increased our corporate value independently of overall market influence. The ESG indicators in (iii) function as guideposts to the realization of important issues that we are taking action on. The total annual amount of monetary claims for restricted stock remuneration shall be no more than ¥200 million per year (the total annual number of shares of common stock to be issued or disposed of in exchange for this compensation is limited to 66,000).

Activities of the Board of Directors and the Nomination & Remuneration Committee in determining the remuneration amounts for directors and Audit & Supervisory Board members for FY2022

Board of Directors

With respect to the remuneration of directors and Audit & Supervisory Board members for FY2022, the Board of Directors resolved at its June 2022 meeting to issue and allot restricted stock remuneration, and resolved at its May 2023 meeting to pay performance-linked bonuses to directors and Audit & Supervisory Board members. Fixed remuneration was paid in accordance with the resolution passed at the May 2021 meeting of the Board of Directors.

Nomination & Remuneration Committee

In FY2022, the Nomination & Compensation Committee held four meetings related to the remuneration of directors and Audit & Supervisory Board members, discussing the payment of performance-based bonuses and the issuance and allotment of restricted stock for FY2022.

Cross-Shareholdings

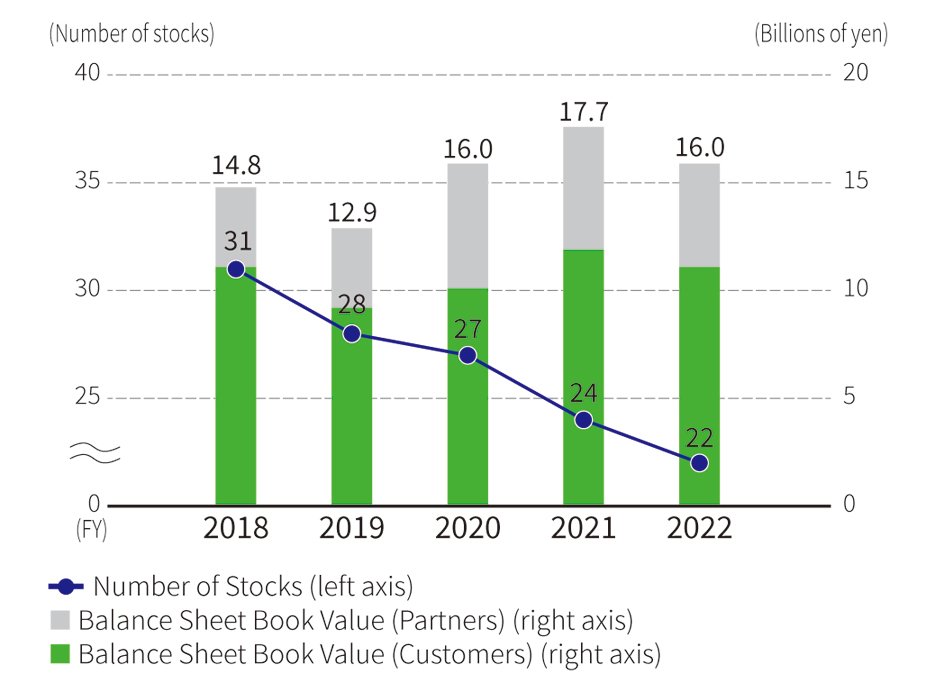

BIPROGY may strategically hold shares of partners if it is deemed that this would contribute to greater corporate value for the Company, such as resulting in a stronger profit basis by maintaining or strengthening the relationship with partners. The determination to acquire stock is made pursuant to its internal regulations. As for the subsequent holding of the shares, the Board of Directors verifies whether it is appropriate each year, and we are working to reduce such holdings. As a result, the total amount of listed stocks on the balance sheet at the end of FY2022 declined ¥1.7 billion from the end of the previous fiscal year, and the number of stocks held decreased by 2 stocks from the end of the previous fiscal year to 22 stocks. Going forward, we aim to reduce the total amount of strategic shareholdings on the balance

sheet to less than 10% of total equity. The verification of shares held as of March 31, 2023, was conducted at the Board of Directors meeting held in June 2023. The results are as follows.

-

The sustainability of the purpose for holding individual shares and the consistency with the business strategy from a medium- to long-term perspective was verified. Based on this result, the shares to be disposed of were confirmed as the significance of their holding had diminished.

-

In addition to the above, the economic rationality for holding shares other than those expected to be sold off was confirmed by verifying such factors as profit from business with the issuer, etc., taking into consideration the cost of capital.

Number of Stocks Held by BIPROGY for Non-pure Investment Purposes and Total Value on Balance Sheet (listed companies)

Policy Regarding Constructive Dialogue with Shareholders and Other Investors

In addition to disclosing information to its shareholders and other investors at a suitable time and in an appropriate manner, the BIPROGY Group engages in proactive investor relations and shareholder relations activities, led by its CEO, CFO, and the executive in charge of corporate governance promotion, in the belief that repeatedly engaging in mutual dialogue leads to the fair assessment of its value. The Group places great significance on the opinions of its shareholders and other investors and reports these opinions to its management and the Board of Directors in a timely manner. These opinions are then used in making improvements to the Company’s overall management.

Internal Control System

Improving the Effectiveness and Efficiency of Business

The Group has established a mid-term management plan and specific management targets, and it strives to develop systems that will improve operational effectiveness and efficiency.

Ensuring the Reliability of Financial Reports

The Company's management and employees have conducted themselves in compliance with the basic policy for appropriate financial reporting established by the Group set forth for ensuring the reliability of financial reporting.

Compliance with Laws and Regulations on Business Activities

In recognition of compliance as one of the most critical issues to the execution of business operation, the Group has established the Charter of Corporate Behavior, the Group Compliance Basic Regulations, and the Group Code of Conduct, based on which all of the Group's employees act ethically in compliance with laws and regulations, social norms, and in-house regulations.

Preservation of company Assets (Risk Management)

The Group is faced with various kinds of risk in connection with its operating business activities. The Company has developed a common risk classification system for the Group to share and centralize the management of risks throughout the entire Group. Furthermore, it has developed preventive measures and countermeasures against the occurrence of risk events in order to safeguard its assets.

Accordingly, the Company has established a Risk Management Committee and Business Continuity Project chaired by the chief risk management officer (CRMO) to unify, lead, and manage risk management across the entire Group.